Stock Beta Zero . beta (β) compares a stock or portfolio's volatility or systematic risk to the market. creating a zero beta portfolio involves selecting assets that, when combined, achieve a collective beta of. Beta provides an investor with an. beta = 0: This means that regardless of how the. A detailed look at their structure, benefits, and potential drawbacks for informed trading. a beta of 0 means that the security’s price is not correlated with the market movements. If the beta is equal to zero, then this implies no relationship. simply put, a zero beta portfolio is a portfolio that has zero correlation to the overall market. In other words, changes in the market have no impact on.

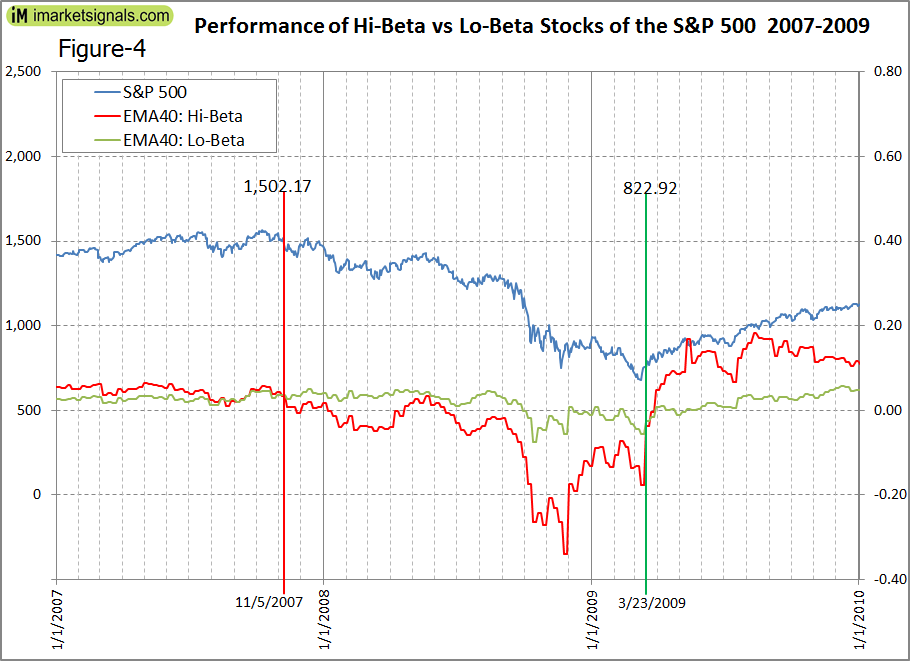

from imarketsignals.com

simply put, a zero beta portfolio is a portfolio that has zero correlation to the overall market. Beta provides an investor with an. a beta of 0 means that the security’s price is not correlated with the market movements. beta = 0: A detailed look at their structure, benefits, and potential drawbacks for informed trading. creating a zero beta portfolio involves selecting assets that, when combined, achieve a collective beta of. beta (β) compares a stock or portfolio's volatility or systematic risk to the market. If the beta is equal to zero, then this implies no relationship. In other words, changes in the market have no impact on. This means that regardless of how the.

Profitable Market Timing Using Performance of the HiBeta and LoBeta

Stock Beta Zero A detailed look at their structure, benefits, and potential drawbacks for informed trading. beta = 0: In other words, changes in the market have no impact on. a beta of 0 means that the security’s price is not correlated with the market movements. If the beta is equal to zero, then this implies no relationship. This means that regardless of how the. Beta provides an investor with an. creating a zero beta portfolio involves selecting assets that, when combined, achieve a collective beta of. simply put, a zero beta portfolio is a portfolio that has zero correlation to the overall market. beta (β) compares a stock or portfolio's volatility or systematic risk to the market. A detailed look at their structure, benefits, and potential drawbacks for informed trading.

From stockoc.blogspot.com

What Is The Difference Between Beta And Volatility STOCKOC Stock Beta Zero Beta provides an investor with an. A detailed look at their structure, benefits, and potential drawbacks for informed trading. beta (β) compares a stock or portfolio's volatility or systematic risk to the market. beta = 0: a beta of 0 means that the security’s price is not correlated with the market movements. simply put, a zero. Stock Beta Zero.

From www.for-sale.co.uk

Beta Zero for sale in UK 56 used Beta Zeros Stock Beta Zero This means that regardless of how the. simply put, a zero beta portfolio is a portfolio that has zero correlation to the overall market. a beta of 0 means that the security’s price is not correlated with the market movements. In other words, changes in the market have no impact on. beta = 0: A detailed look. Stock Beta Zero.

From www.britcycle.com

1990 Beta Zero Trials Stock Beta Zero This means that regardless of how the. simply put, a zero beta portfolio is a portfolio that has zero correlation to the overall market. In other words, changes in the market have no impact on. creating a zero beta portfolio involves selecting assets that, when combined, achieve a collective beta of. beta = 0: a beta. Stock Beta Zero.

From seekingalpha.com

Towards A ZeroBeta Stocks And Bonds Portfolio Seeking Alpha Stock Beta Zero If the beta is equal to zero, then this implies no relationship. beta = 0: simply put, a zero beta portfolio is a portfolio that has zero correlation to the overall market. In other words, changes in the market have no impact on. A detailed look at their structure, benefits, and potential drawbacks for informed trading. a. Stock Beta Zero.

From haipernews.com

How To Calculate Beta Zero Haiper Stock Beta Zero Beta provides an investor with an. beta = 0: creating a zero beta portfolio involves selecting assets that, when combined, achieve a collective beta of. a beta of 0 means that the security’s price is not correlated with the market movements. simply put, a zero beta portfolio is a portfolio that has zero correlation to the. Stock Beta Zero.

From www.pinterest.com

What is Beta? Stock trading strategies, Stock trading learning Stock Beta Zero a beta of 0 means that the security’s price is not correlated with the market movements. This means that regardless of how the. If the beta is equal to zero, then this implies no relationship. A detailed look at their structure, benefits, and potential drawbacks for informed trading. Beta provides an investor with an. simply put, a zero. Stock Beta Zero.

From www.retrotrials.com

1992 Beta Zero brochure Stock Beta Zero This means that regardless of how the. creating a zero beta portfolio involves selecting assets that, when combined, achieve a collective beta of. a beta of 0 means that the security’s price is not correlated with the market movements. beta (β) compares a stock or portfolio's volatility or systematic risk to the market. If the beta is. Stock Beta Zero.

From seekingalpha.com

Portfolio Diversification and Risk The Basics of Beta Seeking Alpha Stock Beta Zero creating a zero beta portfolio involves selecting assets that, when combined, achieve a collective beta of. This means that regardless of how the. beta (β) compares a stock or portfolio's volatility or systematic risk to the market. a beta of 0 means that the security’s price is not correlated with the market movements. simply put, a. Stock Beta Zero.

From seekingalpha.com

Towards A ZeroBeta Stocks And Bonds Portfolio Seeking Alpha Stock Beta Zero simply put, a zero beta portfolio is a portfolio that has zero correlation to the overall market. If the beta is equal to zero, then this implies no relationship. In other words, changes in the market have no impact on. beta (β) compares a stock or portfolio's volatility or systematic risk to the market. This means that regardless. Stock Beta Zero.

From corporatefinanceinstitute.com

Unlevered Beta (Asset Beta) Formula, Calculation, and Examples Stock Beta Zero Beta provides an investor with an. A detailed look at their structure, benefits, and potential drawbacks for informed trading. beta (β) compares a stock or portfolio's volatility or systematic risk to the market. creating a zero beta portfolio involves selecting assets that, when combined, achieve a collective beta of. beta = 0: This means that regardless of. Stock Beta Zero.

From www.ferventlearning.com

What is Systematic Risk (aka Beta)? How to Calculate Beta of a Stock Stock Beta Zero Beta provides an investor with an. This means that regardless of how the. a beta of 0 means that the security’s price is not correlated with the market movements. beta (β) compares a stock or portfolio's volatility or systematic risk to the market. simply put, a zero beta portfolio is a portfolio that has zero correlation to. Stock Beta Zero.

From seekingalpha.com

What Is a Stock’s Beta? Definition, Evaluation, Pros & Cons Seeking Alpha Stock Beta Zero If the beta is equal to zero, then this implies no relationship. simply put, a zero beta portfolio is a portfolio that has zero correlation to the overall market. beta = 0: In other words, changes in the market have no impact on. This means that regardless of how the. a beta of 0 means that the. Stock Beta Zero.

From ca.news.yahoo.com

Portfolio Beta vs. Stock Beta What's the Difference? Stock Beta Zero Beta provides an investor with an. If the beta is equal to zero, then this implies no relationship. In other words, changes in the market have no impact on. beta = 0: simply put, a zero beta portfolio is a portfolio that has zero correlation to the overall market. This means that regardless of how the. beta. Stock Beta Zero.

From www.chegg.com

Solved Question 1 Stocks with a beta of zero offer an Stock Beta Zero creating a zero beta portfolio involves selecting assets that, when combined, achieve a collective beta of. beta (β) compares a stock or portfolio's volatility or systematic risk to the market. beta = 0: a beta of 0 means that the security’s price is not correlated with the market movements. Beta provides an investor with an. If. Stock Beta Zero.

From seekingalpha.com

S&P 500 High Beta Stocks Seeking Alpha Stock Beta Zero simply put, a zero beta portfolio is a portfolio that has zero correlation to the overall market. This means that regardless of how the. If the beta is equal to zero, then this implies no relationship. beta = 0: creating a zero beta portfolio involves selecting assets that, when combined, achieve a collective beta of. a. Stock Beta Zero.

From www.calculatinginvestor.com

t_capm Stock Beta Zero beta = 0: beta (β) compares a stock or portfolio's volatility or systematic risk to the market. a beta of 0 means that the security’s price is not correlated with the market movements. simply put, a zero beta portfolio is a portfolio that has zero correlation to the overall market. Beta provides an investor with an.. Stock Beta Zero.

From seekingalpha.com

Towards A ZeroBeta Stocks And Bonds Portfolio Seeking Alpha Stock Beta Zero This means that regardless of how the. simply put, a zero beta portfolio is a portfolio that has zero correlation to the overall market. If the beta is equal to zero, then this implies no relationship. beta = 0: beta (β) compares a stock or portfolio's volatility or systematic risk to the market. a beta of. Stock Beta Zero.

From corporatefinanceinstitute.com

Beta What is Beta (β) in Finance? Guide and Examples Stock Beta Zero beta = 0: Beta provides an investor with an. a beta of 0 means that the security’s price is not correlated with the market movements. If the beta is equal to zero, then this implies no relationship. beta (β) compares a stock or portfolio's volatility or systematic risk to the market. A detailed look at their structure,. Stock Beta Zero.